加载中...

共找到 13,780 条相关资讯

Although government shutdowns typically have a negligible impact on capital markets, the timing of this one is significant. The shutdown adds to concerns over U.S. institutional credibility, fiscal position and "dysfunction," according to Luke Bartholomew, deputy chief economist at Aberdeen.

The dollar fell Wednesday after U.S. lawmakers failed to avert a government shutdown, raising questions from traders about the potential economic impact.

U.S. President Donald Trump's threat to impose 100% tariffs on branded drugs ratcheted up pressure on pharmaceutical companies to agree price cuts and shift manufacturing after talks faltered earlier this year, industry lobbyists and executives said.

The figure reported on Thursday is below economists' estimates of an increase of 50,000 jobs and also down from the prior month's revised reading of a loss of 3,000 jobs.

As of Oct. 1, 2025, two stocks in the financial sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

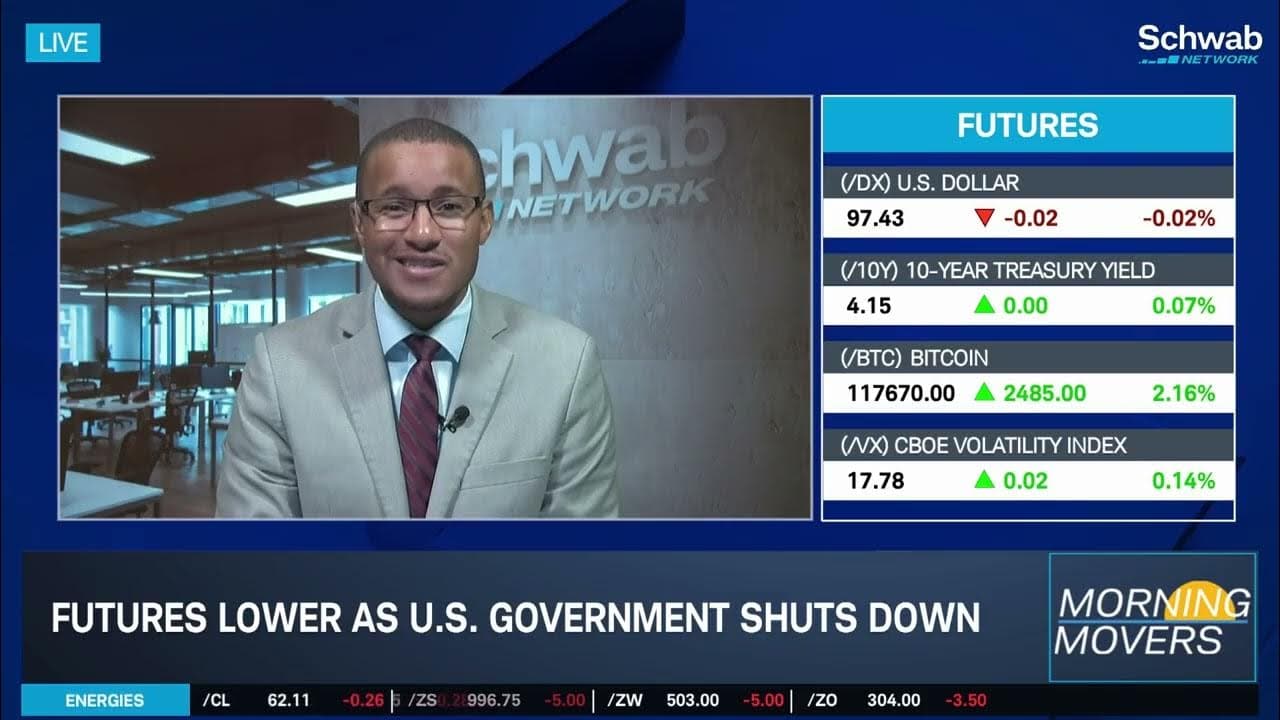

With the U.S. government shutdown in effect, the market's initial reaction has been relatively calm says Kevin Green, but that could change if the stalemate continues. The 10-year yield is currently flat, and the dollar is holding steady, but a prolonged shutdown could lead to a sell-off in equities and a flight to safety in Treasuries.

Despite a government shutdown, major indexes ended their best third quarter since 2010, with limited impact expected unless the closure is prolonged. Labor market stagnation persists, but strong consumer spending and minimal layoffs suggest recession risk remains low and job growth could rebound post-trade uncertainty.

Hours into the US government shutdown, the standoff is already shaping up as a political quagmire for all involved. President Donald Trump has gleefully pinned the blame on “crazed” Democrats, in the hopes they will shoulder the political consequences.

U.S. job openings were essentially unchanged in August amid economic uncertainty arising from President Donald Trump's trade policies and an impending government shutdown.

The ADP private-sector jobs report showed a labor force that continues to deteriorate.

Federal Reserve Bank of Chicago President Austan Goolsbee warned that rising inflation could pose a stagflation risk if tariff-induced price hikes prove persistent.

Sen. Steve Daines (R-Mont.) joins 'Squawk Box' to discuss the fallout from the U.S. government shutdown, sticking points in negotiations between the two parties, and more.

rivately run businesses eliminated an estimated 34,000 jobs in September and employment fell for the third time in four months, ADP said, in another sign of emerging weakness in the labor market that alarmed the Federal Reserve enough to cut interest rates last month.

The critical U.S. jobs report on Friday, which is likely to be delayed by the government shutdown, probably wasn't going to reveal much good news. But it could have told investors if the labor market is getting worse.

Private companies shed a seasonally adjusted 32,000 jobs during the month, the biggest slide since March 2023. The report comes as the funding impasse in Washington, D.C.

On Tuesday, Nike (NYSE: NKE) reported unexpected sales growth for its fiscal first quarter, but simultaneously cautioned that it anticipates a sales decline through most of the holiday shopping season as it works on its turnaround. Despite this mixed outlook, the better-than-expected quarterly results caused NKE stock to trend higher in extended trading.

Priya Misra, Fixed Income Portfolio Manager at J.P. Morgan Asset Management, says bonds remain a hedge, with 5–10 year maturities the sweet spot, and sees Fed cuts ahead if economic data weakens.

U.S. stocks are coasting toward the finish of Wall Street's latest winning month on Tuesday.

Keith Lerner, Chief Investment Officer at Truist Wealth, says shutdown fears are muted, bonds are more attractive at higher yields, and AI and tech remain the strongest long-term market theme.

Mark Haefele, Chief Investment Officer at UBS Global Wealth Management, says more Fed cuts are coming, highlights gold and dollar trends, and sees opportunities in tech, EM, and global resources.