加载中...

共找到 13,872 条相关资讯

Oil futures posted their steepest weekly decline in prices for over three and a half months, as oversupply concerns dominated trading sentiment for much of the week.

Economic risks are piling up, and investors are starting to wonder whether shifting their focus to capital preservation is a good idea right now.

CNBC's Contessa Brewer reports on the action in casino stocks.

Focus in the coming week will center on any developments with the U.S. government shutdown. Wednesday's minutes for the last Federal Reserve meeting will attract a good deal of attention.

Lower rates have spurred the sales of corporate bonds. But bankruptcies are a sign that all is not well in the more shadowy private credit world of bank loans and closed-end funds.

I'm self-employed in a career that I'm afraid could be replaced by artificial intelligence. With a wife and five children to take care of, I have fortunately amassed a decent-size nest egg and have zero debt.

CNBC's “Money Movers” team discusses whether markets should expect delayed IPOs due to the government shutdown with Laura Unger, independent director at eToro Group and former commissioner and acting chair of the U.S. Securities and Exchange Commission.

A big factor for investors is that Japan's stocks are still cheap—and there are positive catalysts ahead.

CNBC's “Money Movers” team discusses markets and small cap stocks with Jill Carey Hall, head of U.S. small and mid cap strategy at Bank of America.

No jobs report and a lack of economic data cloud the picture. But you can still make informed portfolio moves.

Resiliency was the theme on Wall Street to end September and begin the fourth quarter.

Superpowered ETFs make money fast, but cost more than you know.

The government shutdown stems from a spending impasse, leading to the furloughing of 750,000 workers. Past shutdowns averaged 8 days, with the longest being 35 days in 2018-2019.

The stock market rallied back to new highs, led by AI plays. Tesla reversed lower despite record deliveries.

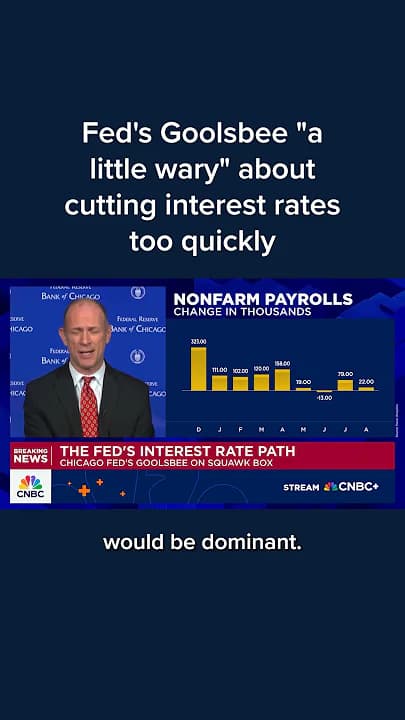

Chicago Federal Reserve President Austan Goolsbee said Friday he's wary of cutting interest rates too quickly as threats increase both inflation and employment. “This uptick of inflation that we've been seeing, coupled with the payroll jobs numbers deteriorating, have put the central bank in a bit of a sticky spot where you're getting deterioration of both sides of the mandate at the same time,” Goolsbee told CNBC.

Markets shrugged off Day 1 of the shutdown, Intel is making a comeback as America's foundry, and traders are already looking ahead to more rate cuts.

Chicago Fed President Austan Goolsbee, discussing the government shutdown on CNBC, said Friday that the longer the Federal Reserve goes on without official statistics, the more blind the central bank will be in understanding the economy and determining policy.

Collin Martin from @CharlesSchwab says ADP employment is not enough to understand what's actually happening in the labor market. The lack of Friday's non-farm payrolls print adds to what he considers a foggy road ahead for a data-dependent Fed.

David Kelly, JPMorgan Asset Management chief global strategist, joins CNBC's 'Squawk on the Street' to discuss why markets continue climbing despite softening economic data, tariff impacts, and why he urges investors to stay cautious and diversify.

The ISM's purchasing managers index for services providers fell to 50.0 in September from 52.0 in August. Economists expected it would remain at the same level of expansion.