加载中...

共找到 13,960 条相关资讯

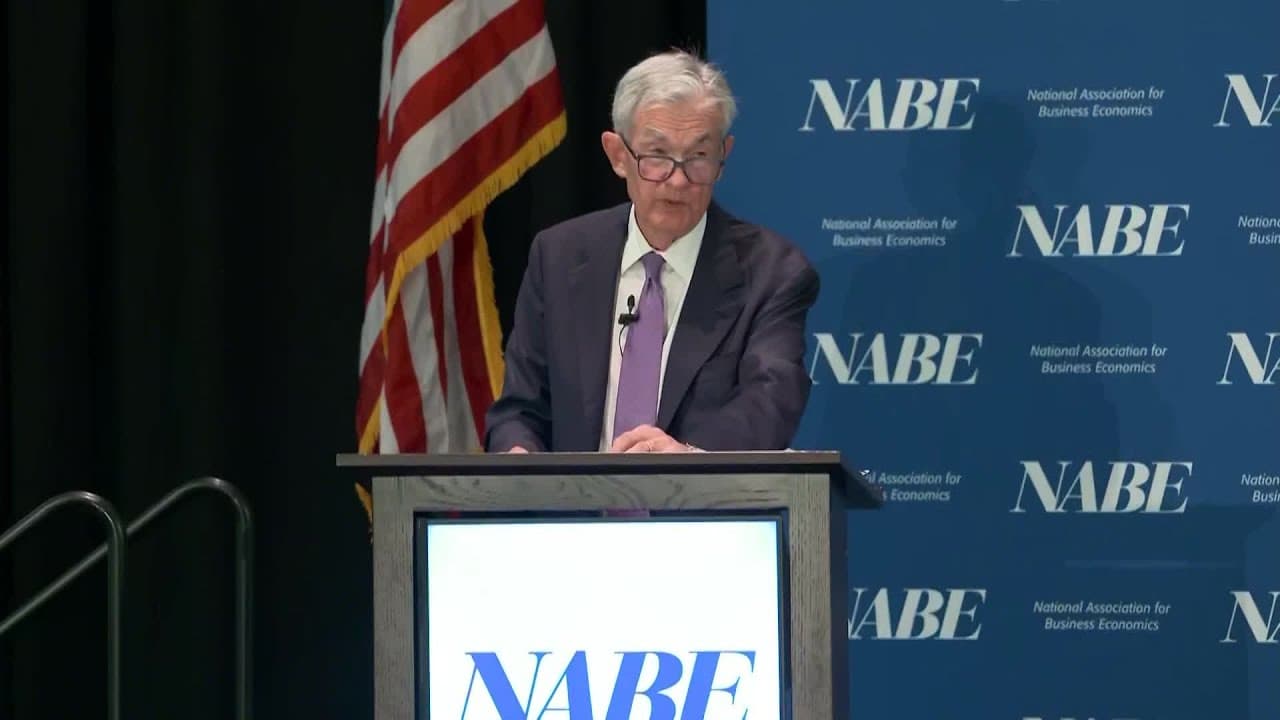

Despite the federal government shutdown cutting off official economic data, “the outlook for employment and inflation does not appear to have changed much since our September meeting,” Powell said.

Fed Chair Jerome Powell told economists that that the sluggish labor market and tariff-induced inflation are persisting as government shutdown delays official employment reports.

Federal Reserve Chair Jerome Powell says the central bank may stop shrinking its balance sheet in the coming months during an event with the National Association for Business Economics in Philadelphia. Sign up for the Economics Daily newsletter to discover what's driving the global economy and what it means for policy makers, businesses, investors and you: https://bloom.bg/4535pfS -------- More on Bloomberg Television and Markets Like this video?

Oil prices slumped to their lowest in five months on Tuesday on market fears of oversupply in the run up to end of the year and first quarter of 2026.

Those looking to buy stocks right now should look for the ones that aren't correlated to the artificial intelligence trade.

The major U.S. stock indexes are back to making dramatic moves, with investors dealing with another round of trade-related uncertainty. One widely used volatility measure, the VIX, has jumped recently to its highest levels in months. But it's still well off April highs.

I reiterate my buy recommendation on assets tracking main American indexes, citing renewed positive outlook despite recent market volatility from tariff concerns. Favorable FOMC minutes, strong earnings season expectations, and falling oil prices support a bullish view for the S&P 500 and related index assets (SPY).

Federal Reserve Chair Jerome Powell said on Tuesday the end of the central bank's long-running effort to shrink the size of its holdings, widely known as quantitative tightening, or QT, may be coming into view.

The central bank has been passively reducing its $6.6 trillion asset holdings since mid-2022, part of a technical effort to unwind its pandemic policies.

Federal Reserve Chair Jerome Powell said the central bank is nearing a point where it will stop reducing the size of its bond holdings, but gave no long-run indication of where interest rates are heading. Though balance sheet questions are in the weeds for monetary policy, they matter to financial markets.

Thanks to higher stock markets and rising corporate dealmaking, results are beating expectations across the big banks.

Politically polarized ‘gridlock' in Washington leads to a significant reduction in both U.S. corporate investment and share prices.

The new products are aimed at helping importers assess and comply with rapidly changing U.S. trade policies.

“We will have $4,300 a month in Social Security.”

Trump trade rep says new 100% tariff on China depends on Beijing's next move

SPY could face increased volatility in the near term amid renewed political risks from U.S.–China trade tensions, with tail risk being particularly concerning. Trump's 100% tariff threat on China seems more like a political move, and it will likely lead to a deadline extension instead of escalating into a full-blown trade war.

What is the golden era of tech investing, and are we still in it? How technology returns have changed over the different eras of tech innovation.

Billionaire Paul Tudor Jones expects the Nasdaq to be higher at year end and he thinks the Federal Reserve benchmark rate will be around 2.5% by this time next year. He speaks on "Bloomberg Open Interest.

Traders on Kalshi and Polymarket are betting the federal government shutdown will extend into next month, with 65% expecting it to last until Oct. 31.

Younger Americans are walking away from screens and rediscovering the physical world.