加载中...

共找到 13,961 条相关资讯

China is escalating not only the trade war, but also the geopolitical situation by banning exports of rare earths for military use, which affects the US Army and NATO. China is also tightening the exports of rare earths for AI use, with "case-by-case" approvals.

Victoria Greene, G Squared Private Wealth CIO, joins 'Power Lunch' to discuss the lack of a market sell-off in recent months, Greene's sentiment and much more.

Writer CEO May Habib and ElevenLabs CEO Mati Staniszewski join Ed Ludlow and Caroline Hyde to discuss the future of enterprise AI as Salesforce's Dreamforce conference kicks off amongst Wall Street angst of an AI bubble. They speak on “Bloomberg Tech.

About Yahoo Finance: Yahoo Finance provides free stock ticker data, up-to-date news, portfolio management resources, comprehensive market data, advanced tools, and more information to help you manage your financial life. - Get the latest news and data at finance.yahoo.com - Download the Yahoo Finance app on Apple (https://apple.co/3Rten0R) or Android (https://bit.ly/3t8UnXO) - Follow Yahoo Finance on social: X: http://twitter.com/YahooFinance Instagram: https://www.instagram.com/yahoofinance/?hl=en TikTok: https://www.tiktok.com/@yahoofinance?lang=en Facebook: https://www.facebook.com/yahoofinance/ LinkedIn: https://www.linkedin.com/company/yahoo-finance

Katie Stockton, Fairlead Strategies founder and managing partner, joins 'The Exchange' to discuss the market's recent performance, Stockton's thoughts on the VIX and much more.

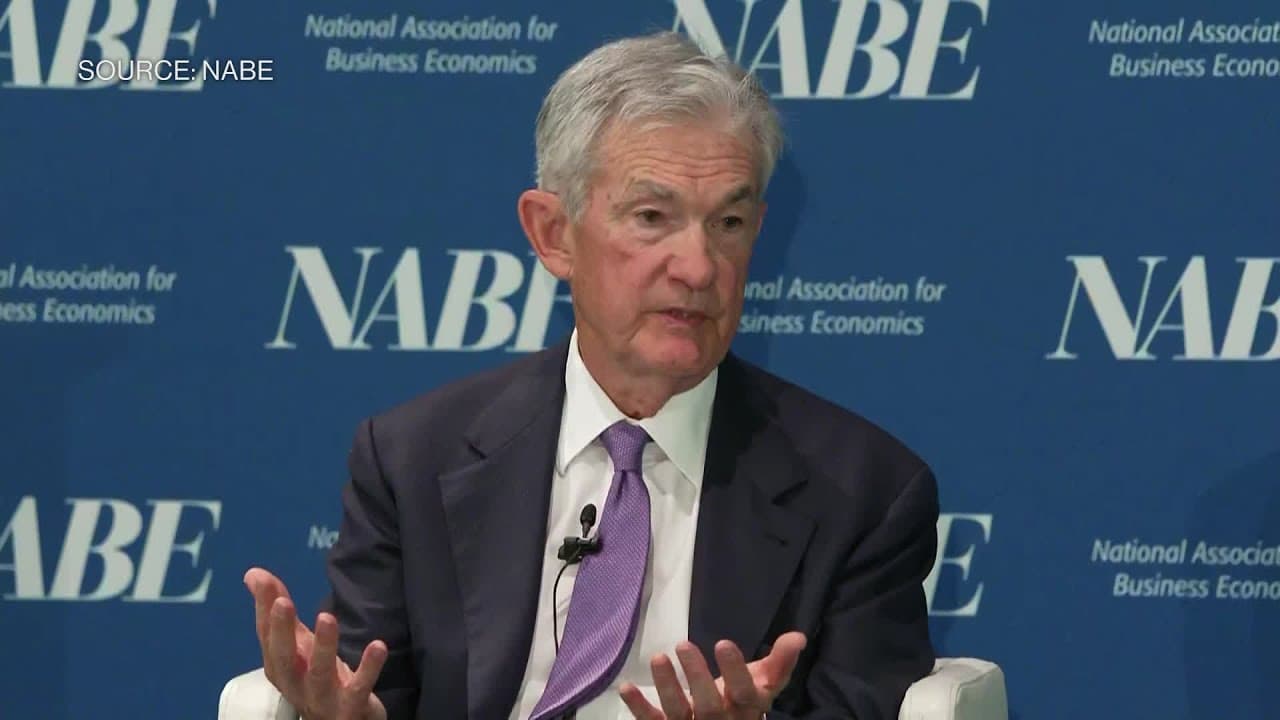

At the National Association for Business Economics' conference in Philadelphia on Tuesday, Federal Reserve Chair Jerome Powell discusses how the government shutdown is impacting economic data.

The central-bank leader also suggested the Fed could be close to ending a three-year campaign to passively reduce its $6.6 trillion asset holdings.

Federal Reserve Chair Jerome Powell delivers the keynote speech on Tuesday at the National Association for Business Economics conference in Philadelphia.

Markets plunged on Friday, due to an unexpected escalation on the trade front between the U.S. and China, the two largest economies in the world. Equities recovered a good chunk of those losses on Monday after some soothing commentary around trade tensions and the latest deal by OpenAI.

Investors don't care if AI stocks are pricey as long as companies deliver hefty profits. But what happens if those profits shrink a lot?

U.S. bank executives expressed optimism that Trump administration regulators will soften capital rules, a major reversal from stricter proposals under the Biden administration.

Federal Reserve Chair Jerome Powell on Tuesday suggested the central bank is nearing a point where it will stop reducing the size of its bond holdings, but gave no long-run indication of where interest rates are heading. Speaking to the National Association for Business Economics' conference in Philadelphia, Powell provided a dissertation on where the Fed stands with “quantitative tightening,” or the effort to reduce the more than $6 trillion of securities it holds on its balance sheet.

Andrew Slimmon, Morgan Stanley senior portfolio manager, joins 'The Exchange' to discuss Slimmon's thoughts on current equity market levels, what worries the portfolio manager and much more.

CNBC's Steve Liesman reports on the latest news regarding the Federal Reserve.

The Pentagon reportedly wants to its missile suppliers to double or even quadruple production.

Dow Jones rebounds 600+ points after early selloff. Financials surge, but tech lags and VIX stays high—caution still clouds US stock market outlook today.

The bankruptcies of U.S. auto parts supplier First Brands and car dealership Tricolor have prompted soul searching on Wall Street, with JPMorgan Chase saying it re-examined its controls after finding itself exposed, although banks broadly said that U.S. borrowers' credit quality is robust.

U.S. and Chinese officials at the senior staff level talked on Monday following a flare-up in trade tensions between the two geopolitical rivals, U.S. Trade Representative Jamieson Greer told CNBC in an Tuesday interview.

Gold and AI stocks are surging right now. I discuss what this indicates could be next for the market.

Federal Reserve Chair Jerome Powell says the labor market is showing "pretty significant" downside risks during an event with the National Association for Business Economics in Philadelphia. Sign up for the Economics Daily newsletter to discover what's driving the global economy and what it means for policy makers, businesses, investors and you: https://bloom.bg/4535pfS -------- More on Bloomberg Television and Markets Like this video?