加载中...

共找到 13,993 条相关资讯

Phillip Wool believes China can stomach more hits from tariffs than the U.S. can. He adds that Chinese markets and its surrounding regions will continue to accelerate, as long as its economy doesn't show substantial slowing.

The simmering U.S.-China trade war is back to full boil this week.

The artificial-intelligence trade may be one of the prevailing narratives in the stock market right now, but it turns out one “boring” sector is actually beating Big Tech in 2025 — utilities.

Federal Reserve Governor Stephen Miran discusses his policy outlook with Sara Eisen at CNBC's Invest in America Forum.

A boom in dealmaking and higher spending point to a healthy economy, while bears are watching frothy stock prices and a weakening job market.

The VIX moved above 20 for the second time since May, signaling that intraday swings are officially back.

Treasury Secretary Scott Bessent said at CNBC's Invest in America Forum on Wednesday that he is "not concerned" about an uptick in inflation because expectations are still well-anchored and many price increases have been "one-time price adjustments."

Vincent Reinhart, Chief Economist and Macro Strategist at BNY Investments, joins CNBC's 'Money Movers' to discuss macro outlooks.

US equities have been on a bull run since, well, take your pick. The Great Financial Crisis low of March 2009, when the S&P 500 hit the devilish level of 666?

Economists have two views of the economic landscape, according to The Wall Street Journal's latest quarterly survey.

Economists have two views of the economic landscape, according to The Wall Street Journal's latest quarterly survey.

Fed Governor Stephen Miran said the latest impasse in trade talks between the U.S. and China poses new dangers to the economic outlook and makes the case for rate cuts even more urgent. Miran has advocated for another 1.25 percentage points in cuts on top of the quarter-point move the Federal Open Market Committee approved in September.

Stocks sold off sharply after renewed U.S.-China tariff fears, but this might just be the excuse markets were looking for. Beyond tariffs, liquidity is what really concerns me right now.

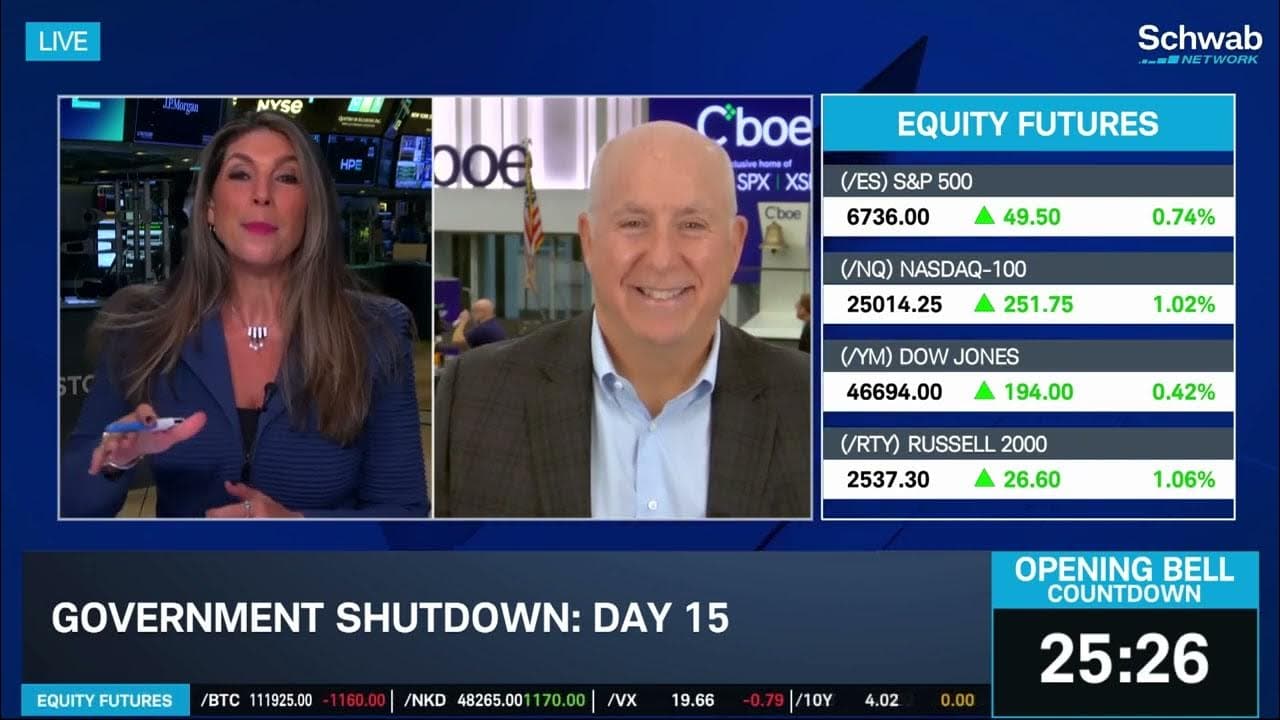

Liz Ann Sonders with @CharlesSchwab says "buy the dip" remains a key rallying cry in the markets, though she notes plenty of risks that can reverse sentiment. Collin Martin talks more in-depth on some of those risks, which includes a backup of economic data from the government shutdown that can derail the FOMC's current interest rate track.

Federal Reserve Governor Stephen Miran sits down with Sara Eisen at CNBC's Invest in America Forum to discuss policy outlooks.

France's financial markets are riding a roller-coaster as the country grapples with one of its worst political crises in decades, and while sentiment is improving, the bumpy ride is not over.

Dow Jones Transportation index stocks are about to begin reporting earnings in earnest.

US stocks advanced on Wednesday, buoyed by stronger-than-expected corporate earnings that outweighed renewed concerns over trade tensions with China. The Dow Jones Industrial Average climbed 161 points, or 0.3%.

Amid heightened volatility on Wall Street due to the escalation of trade tensions between the United States and China, Treasury Secretary Scott Bessent made some significant remarks on Wednesday. While speaking to CNBC, Bessent said the US will not change its negotiating stance on China despite recent stock market declines linked to escalating trade tensions.

Treasury Secretary Scott Bessent's words on the consumer pushed futures higher ahead of Wednesday's opening bell. He alluded to the private sector becoming "unleashed" with help from the government.