加载中...

共找到 14,294 条相关资讯

The Investment Committee debate the setup for stocks as they continue rising higher.

American Century Investments, the $300 billion international asset manager, expanded its ETF family with the launch of two core active small-cap funds: the American Century Small Cap Growth Insights ETF (BATS:ACSG) and the American Century Small Cap Value Insights ETF (BATS:ACSV).

Tim Seymour, Seymour Asset Management CIO, joins 'The Exchange' to discuss if earnings will continue to keep the rally going, markets outside of the U.S. and much more.

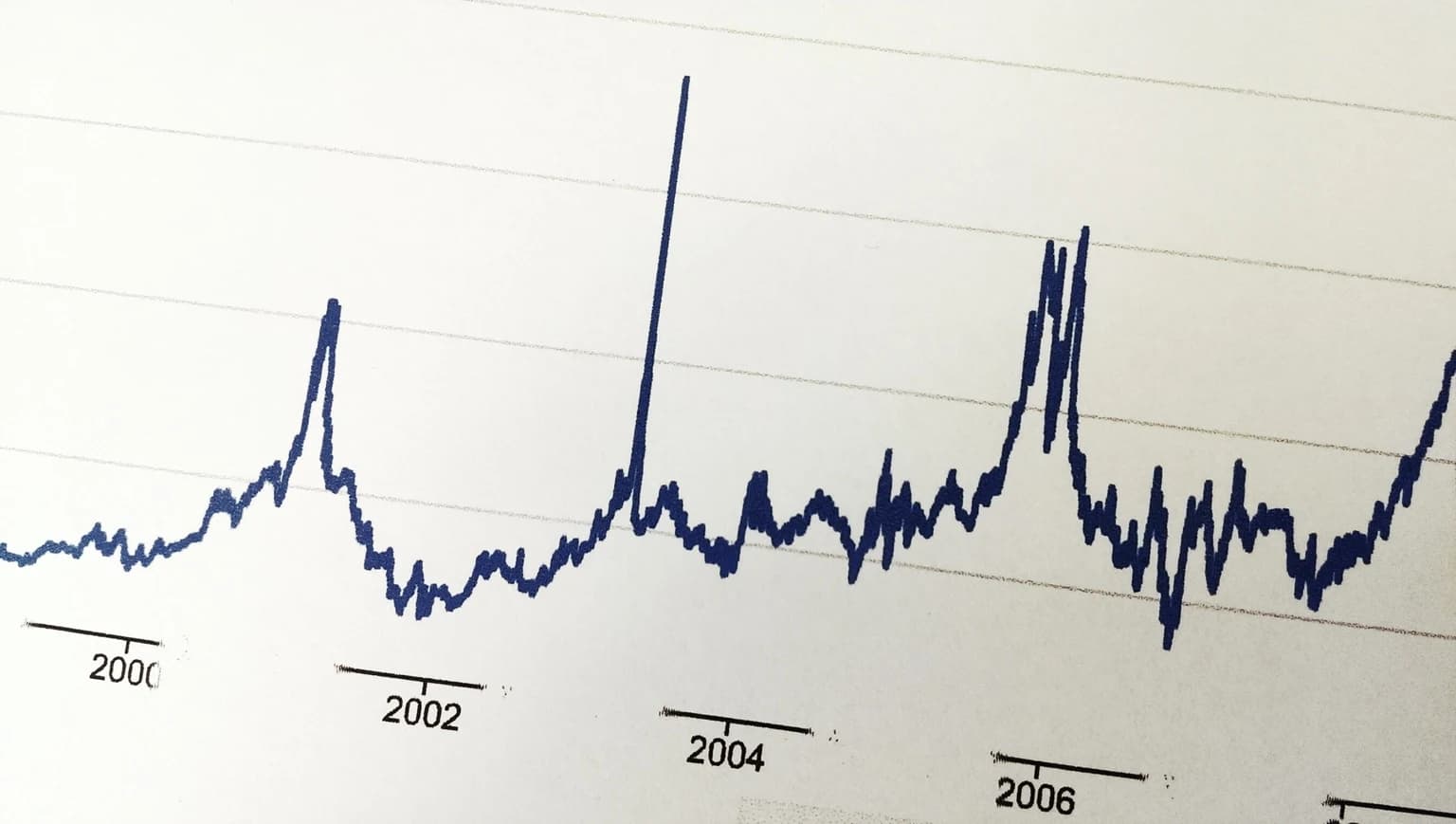

The S&P 500 bounced from the 3% dip as the VIX got crushed and retail investors bought the dip at a record pace. However, the macro uncertainty has not been resolved, and I expect the volatility to remain elevated.

Market strategist Michele Schneider explains why the bull market could be entering “the seventh inning.” Transcript: Caroline Woods: Joining me now, Michele Schneider, Chief Strategist at MarketGauge.

Yield curve has not been impacted by the Fed cutting rates. Credit spreads remain tight with limited room for additional tightening, in our view.

The September consumer price index report coming out Friday will command full attention from financial markets, even as some investors will view the data with a skeptical eye. Though still considered part of the "gold standard" U.S. economic data collection apparatus, the Bureau of Labor Statistics has been criticized for its analog approach.

Prominent consumer-facing companies Coke, 3M, General Motors and Philip Morris all flagged consumer resilience in their earnings reports on Tuesday - depending on the consumer.

The S&P 500's recent rally was driven by a reset in implied volatility, not by fundamental or earnings-related news. Options positioning and volatility mechanics now dominate market movements, outweighing fundamentals and technicals in the current environment.

French beauty giant L'Oréal posted better sales growth trends despite a difficult landscape for beauty groups and noted that it made an improvement in both the U.S. and China.

While today's spending on artificial intelligence has parallels to past bubbles, there are also meaningful differences. News of default and stress from some US regional banks sparked fears of a credit crisis, but it appears to be isolated events.

Investors can already use cryptocurrency to buy commercial real estate assets. It's blockchain, where crypto lives, that commercial real estate is finally adopting.

Concerns about S&P 500 concentration risk are widespread, and arguments seem irrefutable. But it isn't what you don't know that gets you into trouble.

The Fed cut interest rates in September, and another cut is expected to follow later this month. In a rate-cutting cycle, there are some moves investors can make to maximize returns, according to advisors on CNBC's Financial Advisor 100 list for 2025.

Current market risks are elevated, with complacency in valuations, high margin debt, and concentration in mega-cap stocks like NVDA. Potential systemic threats include a Bitcoin crash, rising consumer and business credit delinquencies, and a vulnerable housing market.

Industrial companies are following banks in topping Wall Street's earnings forecasts.

Expanding your horizons and considering neglected sectors can help you identify bargain opportunities while defending your investment portfolio from a stock-market decline.

Factors matter to return objectives, but their makeup is being disrupted in the current environment. A dynamic approach is needed to navigate the rotations.

Stocks were little changed on Tuesday as investors paused following a strong rally in the previous session and weighed a wave of fresh corporate earnings. The Dow Jones Industrial Average rose 49 points, or 0.1%, while the S&P 500 also added 0.1%.

While US stocks didn't make new lows for the week, the VIX made a new high for the week on Thursday and Friday. Investors were jittery!