加载中...

共找到 14,517 条相关资讯

US stock futures pointed sharply higher on Monday, setting up Wall Street for a buoyant open after weekend progress in US-China trade talks and renewed optimism over Federal Reserve policy. Tech stocks were set to drive gains, with Nasdaq 100 futures up 1.3%, while Dow Jones futures rose 0.5% and S&P 500 futures gained 0.8%.

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

The Federal Reserve is expected to cut interest rates 25-basis-points at its meeting this week, though elevated inflation has created a dilemma for policymakers.

Stocks are set to kick off the week on a high note as optimism around a U.S.-China trade deal lifts the market. Kevin Green notes that a potential deal or framework announcement this week could be the catalyst for a S&P 500 (SPX) push to new highs.

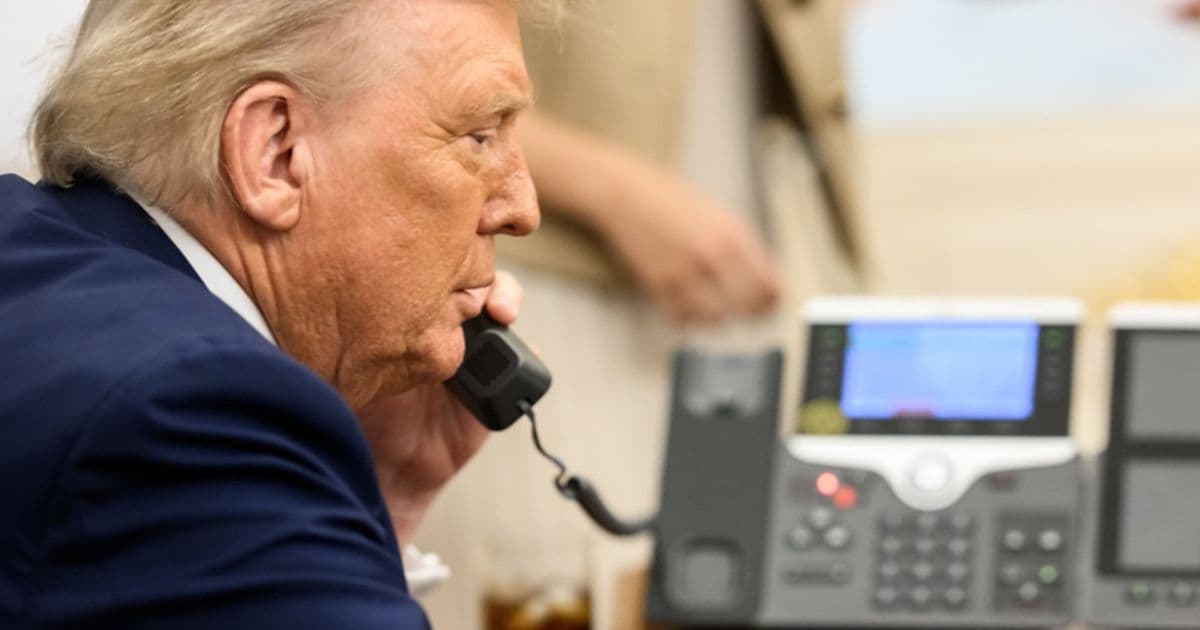

Treasury Secretary Scott Bessent on Monday confirmed that the list of candidates to replace Federal Reserve Chair Jerome Powell has been winnowed down to five Trump himself told reporters that he anticipates naming a replacement by the end of the year, though Powell's term does not expire until May 2026.

“I hope to live off of the combination of Social Security and the TIPS ladder.”

U.S.-China trade truce hopes fuel a risk-on rally in US indices. Nasdaq 100 and S&P500 surge as tech stocks jump ahead of key Fed and earnings events.

Former Cleveland Fed President Loretta Mester joins 'Squawk Box' to preview the Fed's policy meeting this week, what to expect from the central bank's interest rate decision, state of the economy, and more.

As of Oct. 27, 2025, two stocks in the consumer discretionary sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

Jimmy Lee, CEO of The Wealth Consulting Group, says tech, cyclicals, and small caps are poised to rise in a “Goldilocks” market of falling rates and strong earnings, with housing next to rebound.

Nicolas Janvier, Head of North America Equities at Columbia Threadneedle Investments, says market sentiment hinges on trade stability, easing inflation, and the Fed's continued rate cuts.

Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m.

Carter's said it would close about 150 stores in North America and reduce its office workforce by about 15%, cutting roughly 300 positions as tariffs drag down its earnings.

Investors are increasingly favoring U.S. companies that channel capital toward AI innovation over those offering traditional shareholder payouts such as dividends and buybacks, even as the debate over soaring valuations and an AI bubble rages on.

Dow futures rose about 260 points, or roughly 0.5% on Monday, driven by growing optimism over a potential US-China trade deal. This followed weekend discussions leading to a preliminary agreement to ease trade tensions, such as suspending tariffs and export restrictions.

Moody's has maintained its rating for France, even after downgrades by Fitch, DBRS and S&P Global. But the agency revised its outlook for the country from 'stable' to 'negative'.

The U.S. housing market is locked in a cycle of high rates and low supply. This article discusses what this means for the housing market, economy, and stock market.

Ed Yardeni, Yardeni Research president, joins 'Squawk Box' to discuss the latest market trends, state of the economy, the Fed's interest rate outlook, impact of tariffs on the markets, and more.

Ritika Gupta takes the temperature of the U.K. film industry as President Trump's tariff threat plays in the background at the BFI London Film Festival.

Mag 7 earnings and Fed decision headline busy week, officials talk of progress ahead of Trump-Xi meeting, Novartis agrees to buy Avidity, and more news to start your day.