加载中...

共找到 15,054 条相关资讯

The titans of artificial intelligence have been cutting massive deals among themselves—and investors are getting anxious. Unlike giants Google and Amazon, which have piles of cash to finance their own AI infrastructure buildouts, many AI startups looking to scale up fast have little choice but to forge partnerships with investors and suppliers.

Treasury Secretary Scott Bessent is arguably the biggest stock-market cheerleader in American political history. And that fact is throwing a floor under stocks in a way few people realize.

@CharlesSchwab's Nate Peterson takes a look back at last week's price action to explain the moves we're seeing this week. He attributes the weakness to a hawkish interest rate cut from the Fed, a change in A.I.

US stocks declined on Tuesday, led by losses in artificial intelligence-linked names such as Palantir, as investors reassessed stretched valuations following a year-long rally in technology shares. The S&P 500 fell 1.2% shortly after the market opened, while the Nasdaq Composite declined 1.7%.

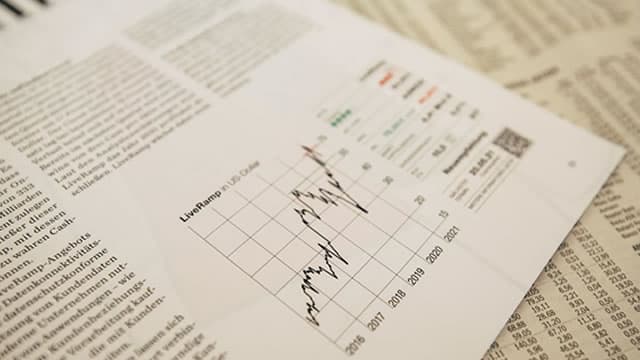

The Global Market Index (GMI) remains on track to generate a 7%-plus annualized total return for the long-run outlook, based on data through October. This estimate of future performance has been steady in recent months, remaining unchanged from the previous month, for instance.

With the Supreme Court about to hear a landmark case on President Donald Trump's tariffs, Treasury Secretary Scott Bessent said Tuesday that there are other options in case of defeat. Bessent expressed confidence in a CNBC interview that the administration will prevail.

The S&P 500 started November with gains, but market breadth remains weak as fewer stocks trade above their 50-day moving averages. Manufacturing sector data remains soft, with ISM showing contraction for the eighth consecutive month, largely due to tariffs and trade policy uncertainty.

Treasury Secretary Scott Bessent joins 'Squawk Box' to discuss President Trump's tariff policy, latest developments in the ongoing federal government shutdown, Election Day 2025, U.S. chip export controls, and more.

Treasury Secretary Scott Bessent joins 'Squawk Box' to discuss President Trump's tariff policy, latest developments in the ongoing federal government shutdown, Election Day 2025, U.S. chip export controls, and more.

Major financial services firms such as Goldman Sachs, JPMorgan Chase, and Wells Fargo have expanded operations in Dallas, Texas, where the firms have thousands of workers.

On CNBC's “Mad Money Lightning Round,” Jim Cramer said he likes Science Applications International Corporation (NASDAQ:SAIC) and recommended buying the stock. “It's an inexpensive stock,” he added.

In the age of the AI bubble, for the most part, stock market capital is flowing into already well-established, well-capitalized and well-managed businesses. However, that does not mean that this cycle does not have its misfit and fringe investments.

Victoria Fernandez, Chief Market Strategist at Crossmark Global Investments, warns stretched valuations and rate concerns put markets on edge, calling Gilead a smart buy as biotech rebounds.

Courtney Breen, Senior Research Analyst at Bernstein, says tariffs have minimal pharma impact, Zepbound is rapidly gaining share in obesity drugs, and Amgen remains her top pick amid mixed earnings.

Brian Gardner, Chief Washington Policy Strategist at Stifel, says prediction markets undervalue Trump's odds in the tariff case and warns smaller firms may struggle if tariffs remain in place.

The risks of a pullback are real. But so is the bull case for stocks.

Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m.

JoAnne Feeney, Advisors Capital Management partner and portfolio manager, joins 'Squawk Box' to discuss the latest market trends, whether we are in a bubble right now, where investors can find opportunities right now, and more.

For the second time ever, U.S. stocks have crossed a valuation milestone, suggesting low future returns.

What matters in U.S. and global markets today