加载中...

共找到 15,144 条相关资讯

Federal Reserve chair Jerome Powell wants to leave office with inflation at 2% and strong job market when his term ends in May 2026, avoiding legacy talk.

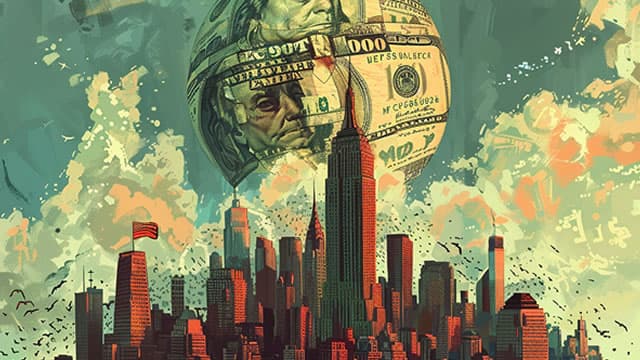

Current market conditions show extreme growth stock valuations, record-high cash at Berkshire Hathaway, and sector rotations, making timing and model selection critical. Many financial approaches offer strong systematic ways to beat the markets, but awareness of sector and market conditions can further enhance your returns.

A delayed November jobs report and key inflation reading are not the only things that could gin up market turmoil.

QQQ, the market leader, is showing technical weakness, raising concerns about the sustained bull market in place since late 2022. Key technical charts on shorter-term time frames for QQQ indicate potential further downside risk.

The Bank of Japan is poised to raise rates for the first time in 11 months, driven by yen weakness and narrowing US-Japan rate spreads. Despite reduced interest rate differentials, Japanese investors continue to favor US equities, sustaining USD strength and yen weakness.

By Kevin Flanagan Key Takeaways With a third consecutive rate cut bringing the Fed Funds range to 3.50%–3.75%, the Fed may pause for now as it reassesses the effectiveness of its “risk management” approach amid mixed economic signals.

I do not believe we are in a market bubble, but recognize risks and advocate for diversification. AI-driven capex is fueling economic growth, yet valuations require margin expansion and prudent asset selection.

The S&P 500's elevated P/E ratio is less alarming when considering strong EPS growth and a modest PEG ratio of 1.22x. The equity risk premium currently favors S&P 500 index funds, offering a 2.4%-2.5% annual return advantage over 10-year Treasuries.

President Donald Trump gave himself an ‘A-plus-plus-plus-plus-plus' grade on his stewardship of the U.S. economy. The economy is getting more fuel, whether it needs it or not.

Lawyers see a small chance that the ruling could come out this week.

S&P 500 Snapshot: Win Streak Puts Index Inches From Record High

Bulls spend a lot of time denying that there's a 1990s-style bubble inflating again. But it's worth going through a few of the similarities and differences.

2026 S&P 500 Outlook: The Party Is Not Over

The 1-Minute Market Report, December 14, 2025

President Trump said he was leaning toward choosing either Warsh or Kevin Hassett to succeed Fed chair Jerome Powell.

The jobs market is seeing contraction in the ADP and jobless claims numbers, and Chris Maxey makes the case that it adds to the labor weakness picture. Consumer health remains intact through metrics like retail sales, but home price increases add pressure in a "K-shaped" economy.

A secondary offering of SpaceX stock, offering liquidity to insiders, valued the rocket company at $800 billion, according to Bloomberg.

The U.S. government has paused a tech-focused trade pledge with Britain over broader disagreements about Britain's digital regulations and food safety rules.

The AI trade is far from over; recent Nasdaq weakness reflects healthy consolidation, not a structural reversal. Despite profit-taking in the Magnificent Seven, NVDA and other AI leaders retain robust demand and dominant positioning.

Each week, Benzinga's Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.