加载中...

共找到 14,517 条相关资讯

European construction shares have been among 2025's standout gainers, lifted by enthusiasm for thematic trades around Germany's infrastructure stimulus, hopes of Ukraine's rebuild and the AI-related boom.

Listen and subscribe to Stocks In Translation on Apple Podcasts, Spotify, or wherever you find your favorite podcast. The math behind your daily scroll might also be shaping your financial life.

CNBC's Jim Cramer revisits his 25 questions for 2025 and reviews what lessons were learned during the past year.

CNBC's Jim Cramer breaks down his views on the market as 2025 comes to a close and details his roadmap to investing in 2026.

CNBC's Jim Cramer revisits his 25 questions for 2025 and reviews what lessons were learned during the past year.

The president said he wants companies to instead spend on new plants.

CNBC's Jim Cramer breaks down his views on the market as 2025 comes to a close.

CNBC's Jim Cramer suggested dealmaking will help drive the market next year. He reviewed potential mergers and acquisitions for 2026, including a bid for Warner Bros.

Dow components and other indexes gain on Monday's stock market as investors await a Santa Claus rally.

CNBC's "Fast Money" team breaks down where the Russell 2000 may be headed and what investors can expect from small cap stocks in 2026 with Julie Biel, chief market strategist at Kayne Anderson Rudnick.

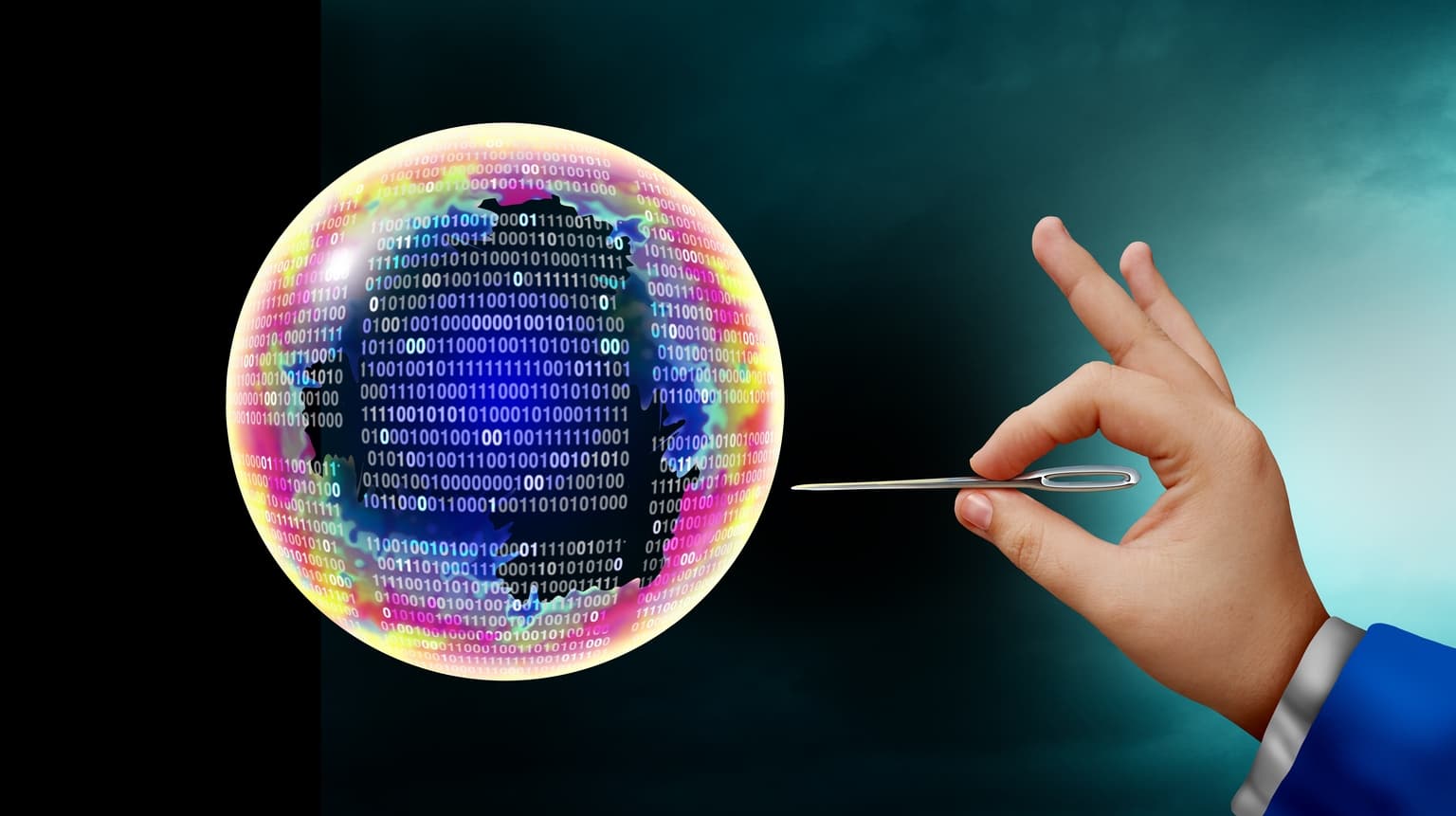

The failed Oracle-Blue Own data center deal likely pricked the credit-driven AI infrastructure bubble, and thus the AI bubble, and consequently the S&P500 bubble. This is likely the Phase one of the AI bubble burst, likely to lead to a reduced AI capex in the next Phase.

CNBC's "Closing Bell" team discusses who may be the next chair of the Federal Reserve, whether the Fed will move to cut rates in 2026 and more with Richard Fisher, senior advisor at Jefferies and former president of the Federal Reserve Bank of Dallas.

I reiterate my buy recommendation on assets tracking main American indices, with a 2026 S&P 500 target of 7787 points. Seasonality supports a year-end rally, with the S&P 500 historically gaining 1–1.88% in the last 10–12 days of December.

CNBC's "Closing Bell Overtime" discuss how markets may perform in 2026 with Carol Schleif of BMO Private Wealth and Bob Doll of Crossmark Global Investments.

Ten of 11 S&P 500 sectors closed higher, along with gold and silver prices.

Space stocks are soaring into 2026, driven by a potential SpaceX IPO and an executive order signed by President Donald Trump.

Economists expect the delayed third-quarter report to show a slight slowdown from the second quarter, but not enough to cause concern.

Valuations are historically stretched; I am defensive and holding significant cash, expecting better buying opportunities in 2026. The S&P 500 Index (SPY) faces high concentration risk and potential double-top technicals, making broad index exposure unattractive at current levels.

CNBC's "Closing Bell" team talks about the bullish signals charts are showing for 2026 with Jeff deGraaf of Renaissance Macro Research.

CNBC's "Closing Bell" team talks about what markets and the U.S. economy may look like in 2026 with Tom Lee of Fundstrat, Stephanie Link of Hightower and Chris Harvey of CIBC Capital Markets.